Ann Arbor Fintech Startup Pocketnest Continue Rapid Growth

By Laura Cowan

Laura K. Cowan is a tech, business, and wellness journalist and fantasy author whose work has focused on promoting sustainability initiatives and helping individuals find a sense of connection with the natural world.

Jessica Willis of Ann Arbor's Pocketnest has encouraging words for other founders working through hard times.

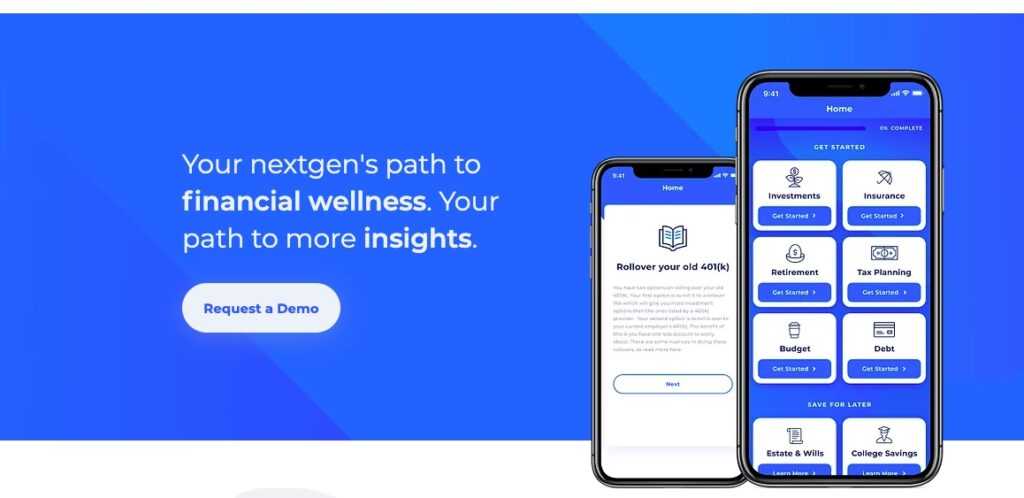

Despite a challenging year, a number of Ann Arbor tech startups are still experiencing rapid growth. First up? Pocketnest, the fintech startup that created a personal financial wellness app to integrate into bank and credit union software to help advise end users on savings and investment decisions while they monitor their finances.

Pocketnest Closes $1.2 Million, Continues Rapid Growth

Fintech personal finance app startup Pocketnest has now closed a total of $1.2 million raised at the end of 2020, ended last year by growing an additional 25% with new hires for a total team of 15, and experienced user growth over its first 12 months of 428% to 1200 users of their banking and personal finance wellness software. It's still early days, but a lot of success for a fintech startup in the middle of a pandemic. Pocketnest founder Jessica Willis says they have had more interest from VCs, and connected a lot as a team during the last year in ways they otherwise wouldn't have. Willis wants to pass on some encouragement to entrepreneurs in hard times: "During a pandemic year or not," she says, "founders need to find your people, your community. There are so many naysayers, even though they can be well intentioned. But starting a company is exhausting. We entrepreneurs make it look easy." Her top tip: find those people who support you, who catch your vision, because it's hard enough building a company in a good year. These days, founders and tech talent alike can use all the community they can get.

Pocketnest is now focused on rapid feature development in their product, and furthering integration to seamlessly work with banking software. The startup has adopted a policy of aiming to release new features or software updates multiple times per month. "Especially after receiving funding, we're hyper focused on building the product and making it as awesome as it can be," Willis says.

Behavioral Science For Financial Wellness Software

Pocketnest has a unique approach to financial wellness software in that it integrates psychology and behavioral science to help advise users on which method of savings and investment might work best for them. "We ask end users about behaviors they react to," Willis says. They do this through building a proprietary platform informed by research based on behavioral scientist and counselor interviews, which helped Pocketnest develop a questionnaire to direct which financial approach users might best respond to. It's not a black and white personality test, but rather a self-directed assessment of tendencies related to financial decision making that help a user decide which approach to financial decision making might work best for them. For example, if you prefer to analyze things logically by paying off debt in order of highest interest rate to lowest, Pocketnest will recommend one method to pay off debt, versus people who prefer to pay off smaller debts and simplify their finances to then focus on paying off larger debts.

Success Is Based in Community

Pocketnest signed its ninth enterprise customer at the end of November. The company has benefited from the acceleration in adoption of mobile banking spurred by the pandemic. But that doesn't mean it's easy to build a company in the current climate. More than anything, Willis says she wants other founders to know that they shouldn't give up during hard times, because things being difficult doesn't mean you're necessarily doing something wrong. "I don't want anyone to feel if it's this hard early on, I can't do it," she says. Pocketnest says their strategy for supporting each other through COVID-19 has been to increase their check-ins to support each other and visit outside of talking about work. You can sense when talking with the team that they do genuinely get along and enjoy working together, and it's not a top-down policy of extra meetings. We wish them continued success and hope to hear more stories like this one, of startups finding their niche, and their community, despite challenging times.

ann arbor startups, jessica willis, michigan tech startups, midwest fintech startups, pocketnest