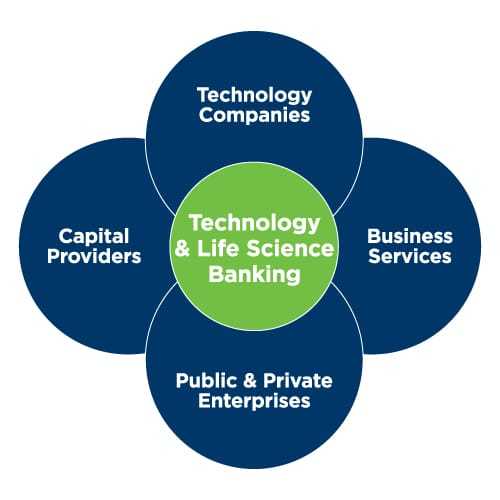

Bank of Ann Arbor Technology Industry Group courtesy graphic.

When new businesses start up, arranging financing can be fraught. When that process involves a bank loan, it's hard to know where to go. Many banks have a reputation for turning away small or risky tech startup businesses. Good news for tech businesses in Ann Arbor and Southeast Michigan. Bank of Ann Arbor, which according to DBusiness is now the 4th largest bank in Metro Detroit, has created an entire division specifically for financing and guiding tech businesses in the growing startup hub. BOAA Technology Industry Group President Michael Cole says this has been a long time in process. Cole has been working for the past 17 years to create business financing options specifically tailored to tech and life sciences businesses in Southeast Michigan.

Cole says he has been working to help develop the innovation space in Ann Arbor tech since before Ann Arbor SPARK merged with the IT Zone. Yes, warm nostalgic fuzzies for those of you who have, like us, been in town long enough to remember the beginnings of talks about Ann Arbor-Detroit as a tech corridor. A lot has been accomplished, but, Cole tells us, a lot still needs to be done. "A big part of my mission was to grow the innovation community in Southeast Michigan," Cole says.

And it's important to him that Ann Arbor and Detroit not be treated as separate ecosystems. He agrees with many other local business leaders that the financing of tech businesses is often different between the two cities and that the industries have a different flavor with more automotive engineering, advanced manufacturing, and tech-enabled startups in Detroit and software, security, and life sciences talent focused in Ann Arbor. But, now more than ever collaboration and connections are what grow the region as a tech hub. That's why Cole is not only working with business owners across Southeast Michigan as a lender, but is literally taking a bus to Detroit to visit several locations of interest to startup owners in the near future and planning events like the Ann Arbor Tech City Jam (schedule below).

Michael Cole, President of Bank of Ann Arbor's Technology Industry Group. Bank of Ann Arbor is now Michigan's 5th largest bank.

How Do You Pitch a Bank President?

If you're thinking of pitching him, we're happy to report that Michael Cole is a very kind and community-oriented person, so that should help calm the nerves to start if you need to approach him for debt financing. Also, he's been working with tech companies of all sizes from startup to Fortune 500 for almost 3 decades, so he really knows how to guide entrepreneurs and sees himself as much a coach as lender. "Naturally that [experience] puts us in the position to connect with a lot of people and to connect others," he says.

Cole's best guidance to tech entrepreneurs is this: "Day 1, first thing a company needs to do is set up a bank account. That's the first step," he says, "so we'll sit down with new founders and walk through the process. For tech founders, there's often a lot of security questions involved related to how the company relates to customers and how they behave digitally." Cole says the Bank of Ann Arbor team will sit and answer questions and guide founders through that setup process and help them connect with the resources they need for their specific venture. "Tech companies have 80% the same questions as other companies," Cole says, "but 20% are different and specific to their unique business and industry."

According to Cole, the process of building a tech business is more about connecting with people than knowing all the step by step processes before you start. What Cole likes about working with Bank of Ann Arbor is that people tend to come to work there and stay there, and that creates lasting connections. "The back office has 10-15 years of working with local tech companies," and this makes a difference, Cole tells us, for entrepreneurs, so they can stay focused on running their businesses.

"The bank has grown from 25-250 people since we launched the Technology Industry Group in 2002," Cole says. "As we've grown, we've been doing more work with larger companies as well."

Whatever the size of the company, Cole says it's imperative to structure financing in a way that works long term. "You do need to be careful how you structure that early stage investment," he says, "or you could stub your toe later."

Trends In Tech Investing

Current trends in tech investment Cole is seeing: "Lots of life sciences, IT, and advanced manufacturing," he lists off. "We're seeing more corporate investment in that space. Auto manufacturers are coming to grips with the fact that they need to be more innovative, and that they might not have all the talent they need in-house." For privacy reasons, he can't give us too many details about what the Technology Industry Group is up to or give information on current clients, but Cole says he's been working more to create events to bring founders together, since it's often those connections that make the most difference in creating an innovative startup hub.

"I love working with Bank of Ann Arbor because they're dedicated to building and continuing to grow and serve the small business community and dedicated to remaining locally owned and operated," he says of the Bank of Ann Arbor community-oriented approach to relationships.

Where can founders learn more about business financing? "There are a growing number of attorneys, accountants, advisors, and capital providers that specialize in that area," Cole tells us. "In business banking, we would try to help guide founders to those resources. For small businesses the value is in starting relationships with the bank, who can act as business partner and advisor."

Attend The Tech City Jam

This Friday, you can meet Michael Cole and a bunch of other tech folks at The Neutral Zone on Washington Street for the Tech City Jam 2019, where local Ann Arbor tech people get together and play music. Cole created the Tech City Jam several years ago for Ann Arbor tech people to come hang out with their many musically inclined colleagues in the industry. The lineup is listed below, but you can sign up (registration required) just to see and meet tech friends at a relaxed event. Tech City Jam runs 7-10 pm this Friday. We'll be there covering the event and hanging out. Please don't elevator pitch Michael Cole while he's hosting, k thx.

Tech City Jam 2019 Lineup

Musical Performances by: The Crossed Lines, Tiny Island Blues Band, Ara Topouzian Trio, Ki5 Loops, The Menlo Bits, Andrew Brown's Djangophonique, Special Guest: Kat Steih, and an inspiring lineup of innovation community performers, including:

- David Brophy, Midwest Growth Capital Symposium

- Andrew Brown, Menlo Innovations

- James Carson, Quicken Loans - Data Science Team

- Michael Cole, Bank of Ann Arbor - Technology Industry Group

- Gabriel Currie, Echopark Guitars

- Mark Forchette, Delphinus Medical Technologies

- Kevin Fulton, Menlo Innovations

- Michael Krebs, Menlo Innovations

- Ben Lorenz, Human Element

- Jason Magee, Human Element

- Bill Mayer, Ann Arbor Spark - Business Accelerator

- Melesa Rose, Microsoft

- Marisa Smith, The Whole Brain Group

- Ara Topouzian, Michigan Venture Capital Association

- Kyler Wilkins, Menlo Innovations