Fintech Startup Pocketnest Explodes onto the Digital Financial Wellness Scene

By Laura Cowan

Laura K. Cowan is a tech, business, and wellness journalist and fantasy author whose work has focused on promoting sustainability initiatives and helping individuals find a sense of connection with the natural world.

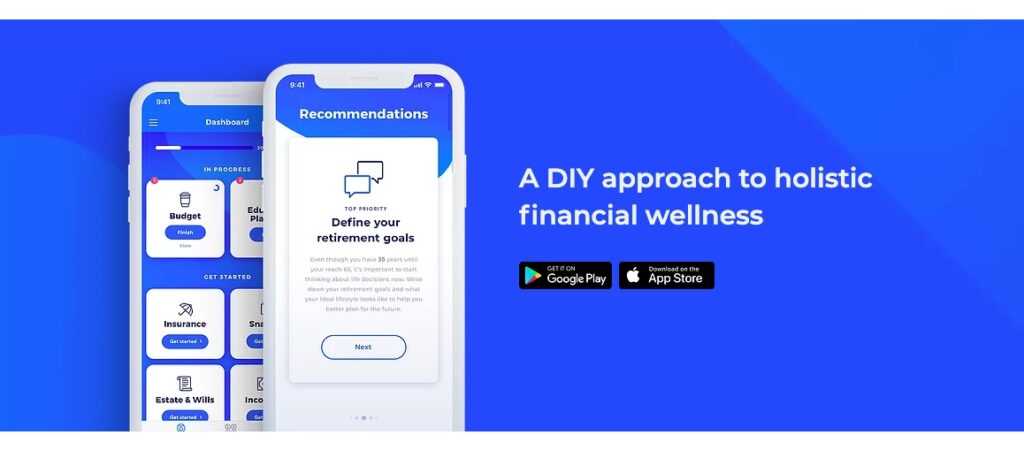

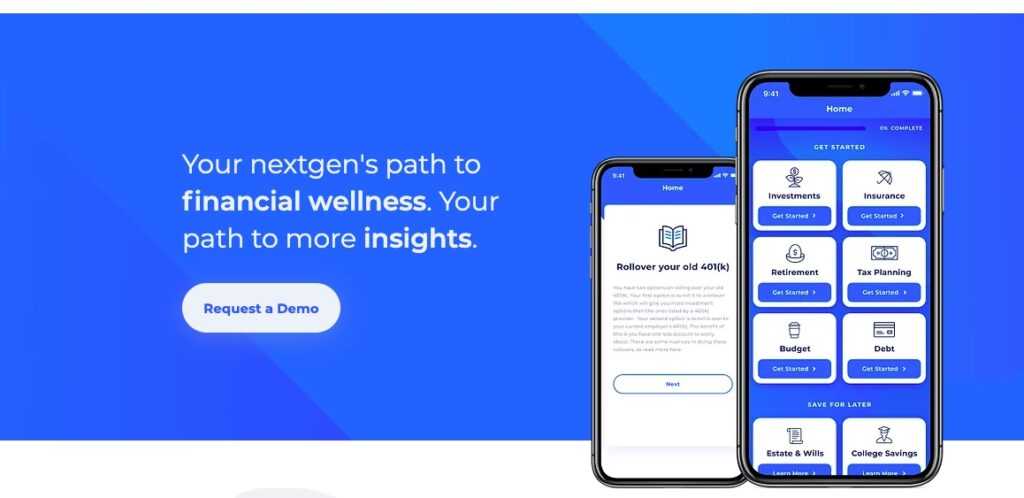

Pocketnest, a new app for next-gen financial wellness used by top credit unions and companies like Cisco-Diag and The Henry Ford, has experienced explosive growth over the past year after closing its pre-seed funding round in 2019. The Ann Arbor-based fintech startup was launched by financial advisor Jessica Willis just 12 months ago after realizing there was very little out there in the way of non-transactional financial wellness apps for Gen X and millennials who were looking for technology to ease communication with financial advisors and to glean accessible financial wellness education and advice. Now boasting 8 enterprise clients with 20% user growth month over month and 40% growth month over month from an enterprise standpoint, Pocketnest now works with some of the largest credit unions in the United States--Wright-Patt Credit Union, Lake Trust Credit Union, and MSU Federal Credit Union--and growing.

Why Financial Wellness Software Matters for Millennials

Willis was a certified financial planner and certified private wealth advisor for 20 years, and says she was the friend everyone knew they could buy lunch and get tons of free personal financial advice. "They kept asking the same questions," Willis says, mainly what to do about financial decisions following major life changes of various kinds. And, she says, they would always say, "I feel like I should know this stuff by now." She decided this financial advice needed to scale to serve a new generation. Pocketnest was born.

What Is a Financial Wellness App?

The tech is a white labeled software that institutions can use to serve their customers under their own brand. It's based in 10 areas of financial wellness education, tracking and advice, from investments to estate planning and budgeting, that help people who want to use tech to engage with financial decisions a way to get quick advice but also check in with an advisor for personalized recommendations at their financial institutions before they make big decisions. Pocketnest links into an end user's financial accounts and can use calculators and planners to help customize financial advice to fit their situation.

What's interesting about this kind of non-transactional banking tech is that it can still feed back use information to banks to give them useful analytics on what their customers might need help with. "Many financial institutions have ignored millennials or younger users who are more likely to use tech like this because until we have $1 million in assets, the financial industry struggles to give good financial advice tailored to the individual," Willis explains. With data mining like this, financial planners and banks can glean more customized insights into their clients' situation and needs and can give more personalized advice at a quick glance.

Use Cases for Financial Wellness Apps

Banks might use Pocketnest to identify cross-selling opportunities for loans. Credit unions to provide opportunities to check in on financial wellness of members. And employee benefit providers love to scale and serve through software, Willis says. Insurance companies can cross-sell financial services. But more than anything the benefit is to the end user, who chooses how to engage with the app. The idea is that using behavioral science and psychology paired with financial education materials, Pocketnest can get users into the habit of checking in on their financial wellness like they might a mindfulness app, create good habits to track their finances, and then have an easy way to reach out to a real human being to check for customized advice before making decisions on things like consolidating 401ks or starting a college fund. "People want to be able to make that connection before really making big decisions," Willis explains, and so Pocketnest brings together the ease of research and tracking and the opportunity to talk to an advisor, which can be challenging in and of itself at large financial institutions.

"We want you to begin with 3 minutes a week to hang out" with the app, Willis says. Banks are using apps to keep younger people engaged who, especially now, will not physically visit a bank for long periods of time. There is a massive change going on in how banks need to embrace technology to facilitate remote banking, something Willis says was already on the horizon 5 years out, but now has been pushed up to this year because of the coronavirus outbreak.

There is pushback. Older generations often don't care for remote banking and have an established habit of in-person financial transactions. Willis says this app is solidly aimed at the next generation, which is not the next generation financially speaking but the generation now raising children and making the most financial planning decisions. The idea is to bring financial wellness planning to the masses, not just keep it for those with large savings already amassed. There are certain things that still need to be handled in person, such as a physical for purchasing life insurance, signing certain estate docs you need witnessed. But more than ever before, financial institutions are embracing technology to engage with users and help them plan a better financial future, and that means advice, estate planning, and education for the rest of us.

ann arbor news, ann arbor startups, financial wellness apps, fintech, michigan business news, midwest startups, pocketnest, startup news