record-breaking VC investment draws 43x investment dollars to Michigan

By Laura Cowan

Laura K. Cowan is a tech, business, and wellness journalist and fantasy author whose work has focused on promoting sustainability initiatives and helping individuals find a sense of connection with the natural world.

Michigan is a flyover state no longer. Even in the midst of a pandemic that shut down swaths of business, venture capital was still at work. Why should the average person or even tech worker care about money that doesn't end up in their pocket? Venture capital doesn't just enable new businesses to get up and running instead of having to move to other states where funding is easier to find. It also attracts investment dollars to the state. The Michigan Venture Capital Association says that for every $1 invested by venture capital in the state, $42.87 is attracted from investment outside of Michigan. That's big news.

Flash back 20 years to before the MVCA was founded in Michigan. Since that time, $6.6 billion has been invested in Michigan in venture capital. Which actually isn't that much compared to the number of companies started in university research corridors or out of the automotive industry in the state. Compare to that the $1.4 billion in venture capital invested in Michigan in 2021, and you can being to see the acceleration. There were 161 VC deals impacting 154 companies in Michigan in 2021. And since venture capital tends to go to the fast-scaling high-tech startups and not bootstrap or slower growing companies that don't require this type of funding to get on their feet, the amount of total investment of other kinds into Michigan companies and the number of companies succeeding without venture capital is much larger still.

For perspective, the MVCA states that $5.4 billion of total capital is under management in Michigan in 2021, which is a whopping 671% increase from $700 million since 2011. Since 2006, there have been 1,593 venture capital deals in Michigan.

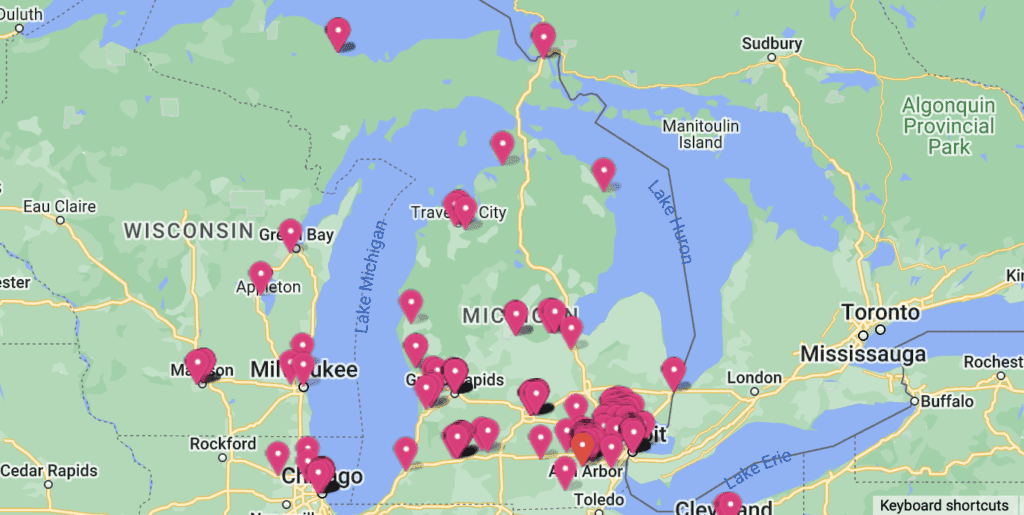

Want to find funding for your startup? The MVCA features a funding landscape map to find the funds located close to your business.

In smaller but very relevant news, GM Ventures became a sponsor of the MVCA in early 2022, indicating that even the slow-moving auto industry has caught on to the value of investment capital and startup activity in the state. While GM, Ford, Chrysler, and other automakers have historically innovated from the inside, sucking up patents created by employees, increasingly, the smaller more nimble auto industry of today is partnering with startups or acquiring those software companies that create integrated solutions for tomorrow's EVs.

Despite the challenges of the last few years, venture capital in Michigan hit record-breaking levels in 2021, after being listed by Crunchbase last year as the state with the fastest growing VC investment for the last 5 years. The number of venture-backed startups in Michigan has grown a phenomenal 56% in the last 5 years. That $5.4 billion invested into Michigan businesses by venture capital last year was a 100% increase over the last 5 years.

You get the idea. In 2021, there were 19 exits in Michigan, also the largest number ever in a given year. Also slightly encouraging is the fact that 14.7% of Michigan venture-backed startups were led by a diverse CEO, compared with 7.6% of CEOs of Fortune500 companies in the U.S..

Angel investing is following close behind: In 2021, 111 Michigan startups raised $76 million from angel investors.

“For a year that saw many records being broken nationwide, we were proud to see that Michigan beat both the National and Great Lakes region average for investment volume,” said Jeffrey Rinvelt, MVCA Chairperson and Partner of Renaissance Venture Capital. “Our report is more than facts and figures; it tells the story of the enormous impact and resiliency of the venture-backed businesses and how Michigan is becoming a leader within the Great Lakes region.”

funding news, michigan angel investing, michigan tech funding, michigan venture capital, michigan venture capital records, michigan venture capital report, mvca