What Will Happen With Tech Investing in 2024?

By Tim Busbey

Tim Busbey is a business and technology journalist from Ohio, who brings diverse writing experience to the Cronicle team. He works on our Cronicle tech and business blog and with our Cronicle content marketing clients.

What Will Happen With Tech Investing in 2024?

As we step into 2024, the tech investing scene continues to evolve under the influence of global economic changes and shifting investor priorities. For startups and investors in the tech arena, understanding these trends is not just beneficial—it's essential. This article explores the current state of tech investing, the leading industries capturing investor interest, and the startups making waves in this dynamic environment.

Current State of Investing

The Retraction of Hedge Funds

A significant development in the VC world is the withdrawal of hedge funds. During the tech boom fueled by the pandemic, these funds played a pivotal role in driving deal-making. However, the current market downturn and LP withdrawals have prompted a shift. Major players like Tiger Global are pivoting away from venture capital, opting to sell startup stakes in secondary markets. This trend underlines the transitory nature of investment sources and underscores the need for startups to diversify their funding strategies.

Regional Resilience Amidst National Decline

While national VC investments observed a downtrend in 2022, specific regions like Michigan bucked this trend. Michigan saw a 12% increase in VC investments from the previous year, reaching $1.2 billion. This regional growth, set against the national backdrop of decline, highlights the uneven distribution of investment activities across the U.S. and emphasizes the importance of geographical factors in fundraising strategies.

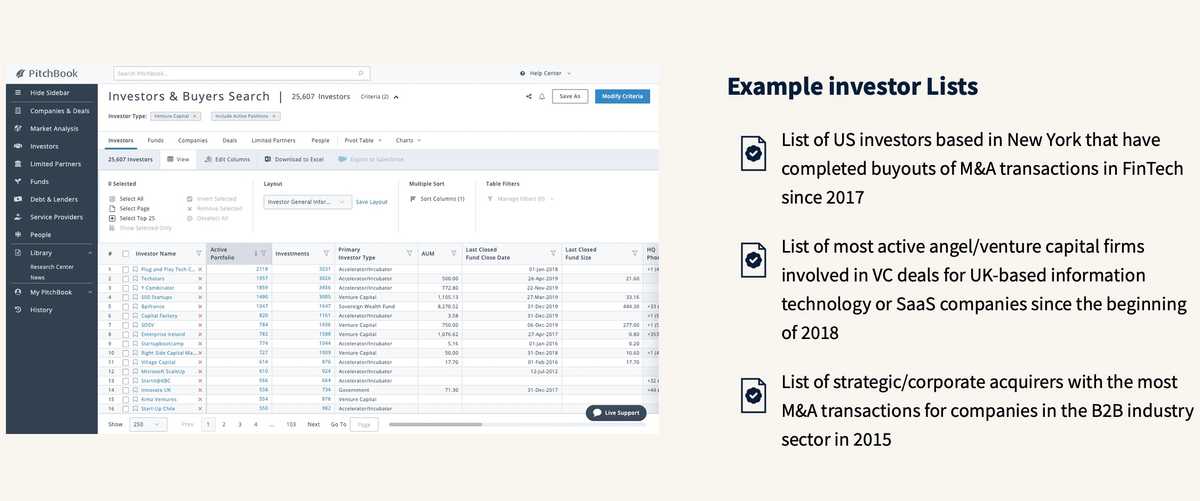

Current Top Industries Attracting VC vs. Angel Investing

Sector-Specific Investments Gain Traction In 2023, venture capital showed a clear inclination toward sector-specific investments. Sectors such as FinTech, HealthTech, and CleanTech have been at the forefront, experiencing substantial growth. Additionally, AI-driven solutions, remote work technologies, and cybersecurity have been major magnets for VC funds. For tech startups, aligning with these trending sectors could be pivotal in attracting substantial investments.

The Changing Face of Angel Investing

Angel investing has witnessed transformative trends, notably the rise of syndicate investing and the emergence of operator angels—seasoned entrepreneurs who offer capital, advice, and networks. This evolution is making angel investing more accessible and varied. Moreover, there's a commendable shift towards more diversity among angel investors, which is enriching the startup ecosystem with diverse perspectives and opportunities.

Notable Startups Seeing Success

Spotlight on Diverse Innovators

The startup world is brimming with innovative companies making significant strides. From Verge Aero's cutting-edge drone shows to Pulsora's sustainability management platforms, the breadth of innovation is impressive.

Voxel51's advancements in AI for computer vision and Traxen's AI-powered automotive technologies are further testaments to the diverse and thriving startup landscape.

Other companies making gains include:

Refraction AI: In the realm of AI-powered delivery, Refraction AI has launched delivery robots that are reshaping the way goods are transported. Their innovative approach to delivery services showcases the practical applications of robotics in daily life.

MemryX: A leader in AI hardware development, MemryX's partnership with Edge Impulse is transforming the AI workflow, streamlining the development and deployment of AI models. This collaboration highlights the growing importance of AI in various technological applications.

BlastPoint: With over $5.25 million in seed funding, BlastPoint is a testament to the potential of AI-powered data tools in the market analysis sector. Their focus on making AI accessible and affordable is crucial in today's data-driven world.

Strata Oncology: Strata Oncology's work in precision oncology, particularly with their Immunotherapy Response Score, is a significant contribution to cancer treatment. Their approach to personalized medicine is a prime example of how startups are driving medical innovation.

These companies, with their significant funding rounds and strategic alliances, exemplify the vibrant potential within the tech startup ecosystem.

What Will 2024 Hold for Tech Investing?

The tech investing environment in 2024 presents a multifaceted and ever-shifting landscape. The retreat of hedge funds from VC, the resilience of specific regions like Michigan, and the concentrated focus on certain tech sectors illustrate the dynamic nature of tech investing. The thriving diversity among startups underscores the continued potential for innovation and growth in the sector. For players in the tech startup world, staying attuned to these trends is crucial for navigating the complex and exciting terrain of tech investing.

tech news, funding, startups, venture capital, angel investing