chicago-startups

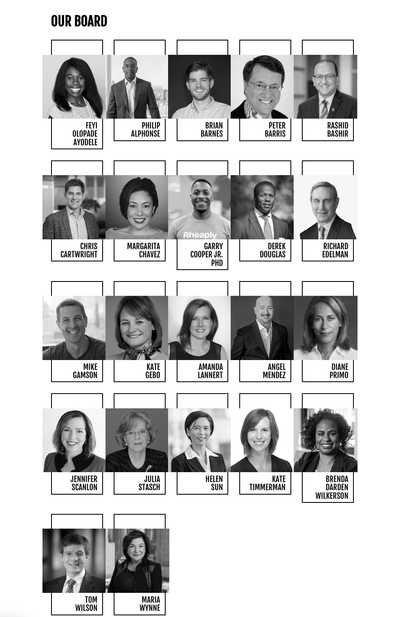

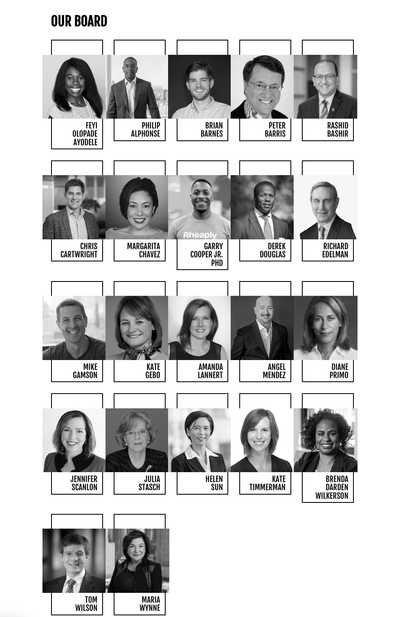

P33 Announces New Board Members

P33 Hires Some Familiar Faces to New Board Chicago startup incubator and tech networking hub P33 has just announced new board members, some…

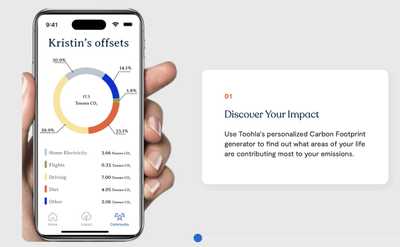

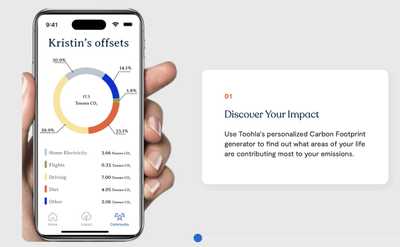

App Helps You Track Your Impact Fighting Climate Change

Do you feel a bit helpless watching the climate change, or are you tired of wondering if each new solution is mere greenwashing or too vague…

QualSights raises just under $8 million for IoT AI consumer research platform

QualSight's combination of research on consumer habits and IoT sensors allow brands to capture insights on product design and usage…

How Is Your Company Weathering the Economic Shift? Send Us Your Tips.

Startups with a few years under their belt based in the Midwest might have an easier time than new startups (pictured above a May Mobility…

Chicago Startups Continue Fundraising Streak

Salesforce Tower, Chicago, courtesy Salesforce. Built in Chicago reports this week that it has been another busy month for the windy city's…

Chicago's Fly.io Closes $37 Million in Funding, Is Hiring

Chicago's Fly.io helps small companies launch and run applications with a global network of servers with low latency and affordable prices…

The 2020 Midwest Tech & Venture Capital Scene with Chicago's Hyde Park Ventures

Hyde Park Ventures' Managing Director Guy Turner heads up the Chicago office of the VC investing firm. With everything going on in the world…